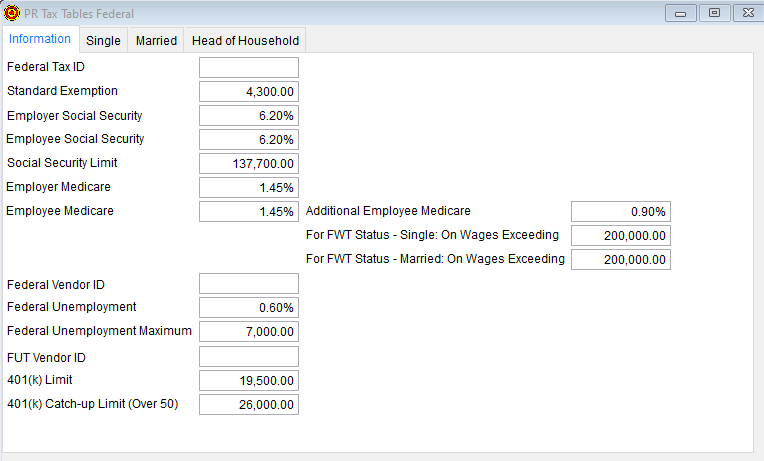

2020 Federal Tax Table - Admin > Payroll Tax Tables > Federal

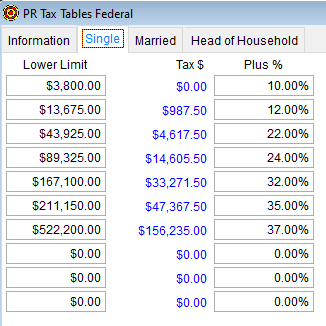

Single Tab

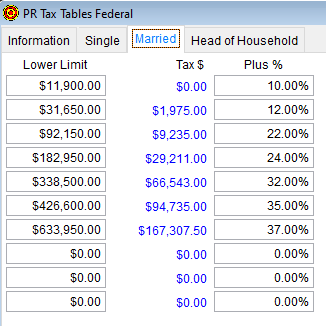

Head of Household Tab

REVISED - 01/30/2020

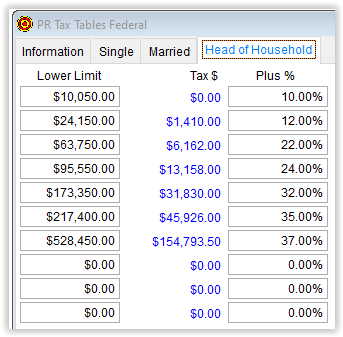

Married Tab

Federal Unemployment tax is generally .6% on the first $7,000. However, employers in credit reduction states are subject to a higher rate. Check with your accountant to determine your rate. 401K limits pertain to payroll deductions where “Section 401K Deduction (non-Roth)” is checked.

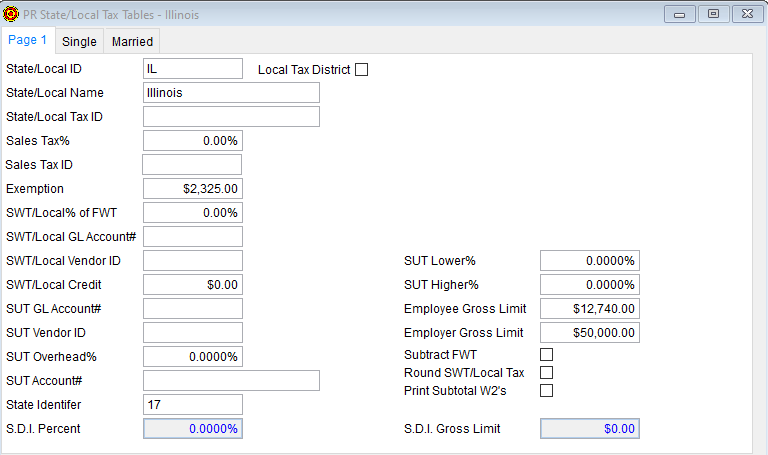

2020 Illinois State Tax Table - Admin > Payroll > Tax Table > State/Local

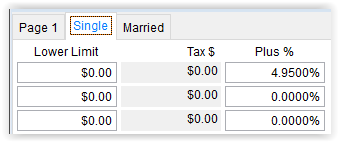

Single Tab

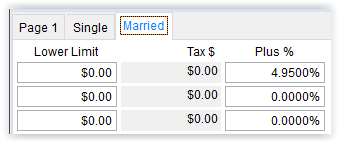

Married Tab

Customers with a support contract may email [email protected] or call (630)355-8188 for assistance.

Publication 15 (Circular E), Employer's Tax Guide for use in 2020 is posted to the IRS website.

The Illinois Department of Revenue Booklet IL-700-T Illinois Withholding Tax Tables are effective January 1, 2020. The tax rate is 4.95%.