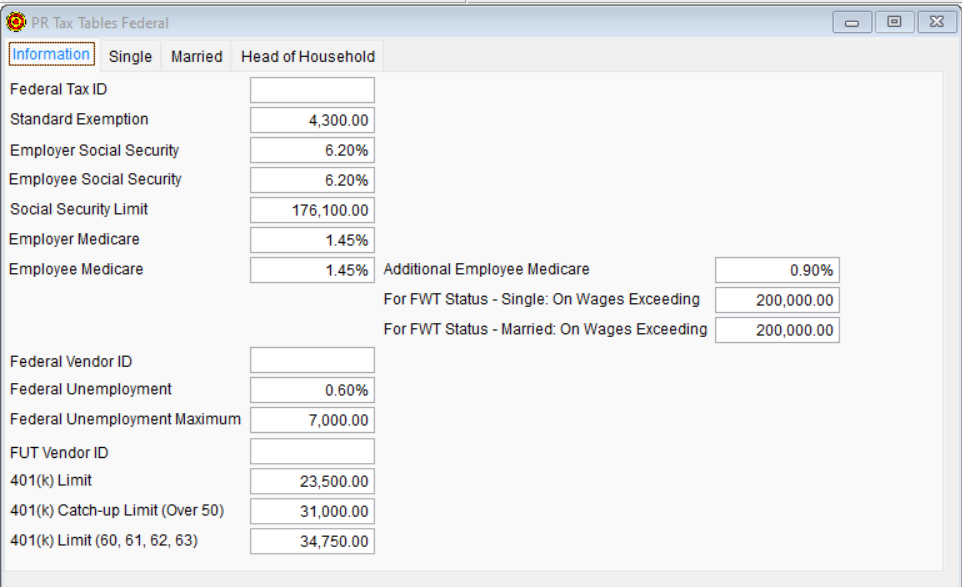

2025 Federal Tax Table - Admin > Payroll Tax Tables > Federal

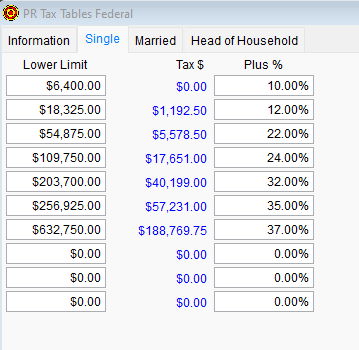

Single Tab

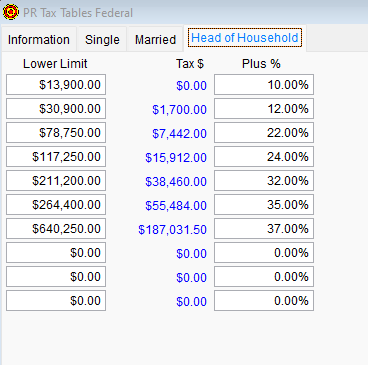

Head of Household Tab

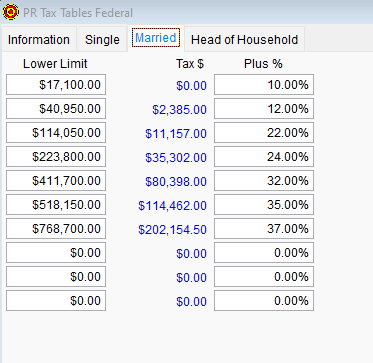

Married Tab

Federal Unemployment tax is generally .6% on the first $7,000. However, employers in credit reduction states are subject to a higher rate. Check with your accountant to determine your rate. 401K limits pertain to payroll deductions where “Section 401K Deduction (non-Roth)” is checked.

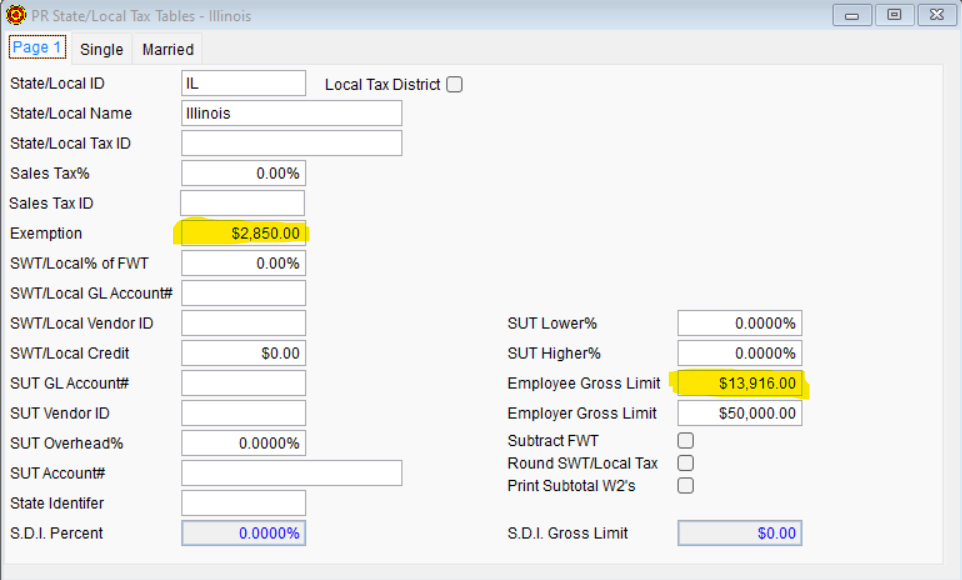

2025 Illinois State Tax Table - Admin > Payroll > Tax Table > State/Local

Updated January 3, 2025

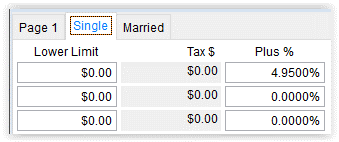

Single Tab

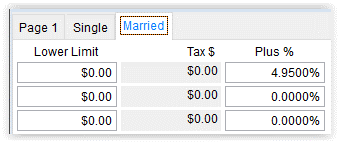

Married Tab

Customers with a support contract may email [email protected] or call (630)355-8188 for assistance.

Publication 15-T, Employer's Tax Guide for use in 2025 is posted to the IRS website.