Updated January 3, 2024

Step 8 of Year End Instructions

8) ILLINOIS DEPARTMENT OF REVENUE REQUIRES ELECTRONIC FILING

Please contact [email protected] for help with this.

E Services W-2 Transmitter website is no longer available. MyTaxIllinois accepts W-2 files in CSV format, which can be created using a Crystal Report through Visual ContrAcct.

Click the icon below to download a zip file, then copy/paste the report to your Desktop or Crystal Folder. Run the report through Crystal Reports Viewer: Reports>Crystal Reports Viewer>2023 State Illinois W2 Electronic Filing MyTaxIllinois Export CSV Format. You may need to browse to find the report.

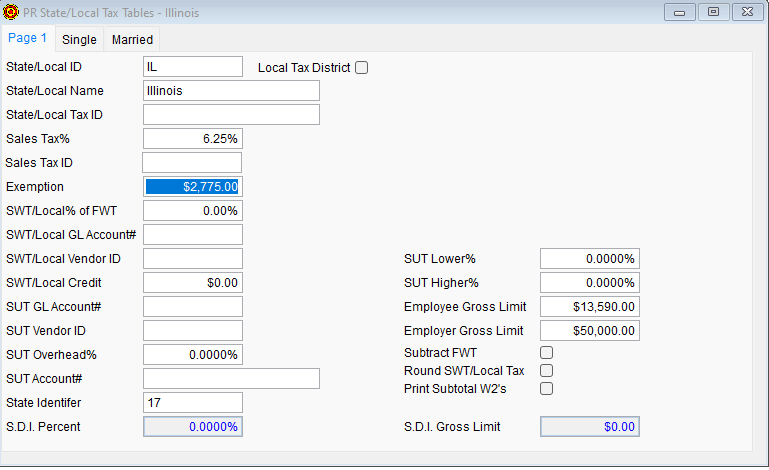

lL Tax Table Has Been Updated

Admin>Payroll>Tax Tables>State/Local

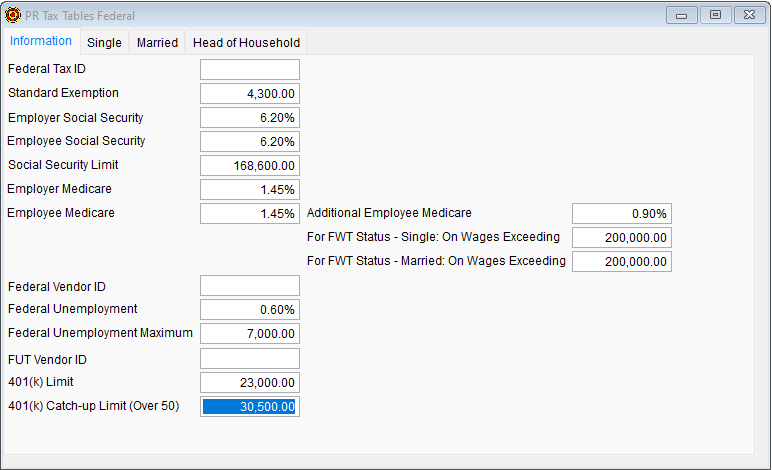

Please Check Federal Tax Table 401(k) Catch Up Limit

Admin>Payroll>Tax Tables>Federal

The correct amount to have in the 401(k) Catch Up Limit is $30,500

See screenshot below.

Customers with a support contract may email [email protected] or call (630)355-8188 for assistance.