Customers please update your Visual ContrAcct 2023 Illinois Exemption

On July 6, 2023 we received notice from the Illinois Department of Revenue that effective June 7, 2023, Public Act 103-0009 maintained the 2022 Individual Income Tax personal exemption allowance at $2,425 for 2023.

At the beginning of 2023, Illinois said it would be $2,625, but Illinois legislators changed their mind.

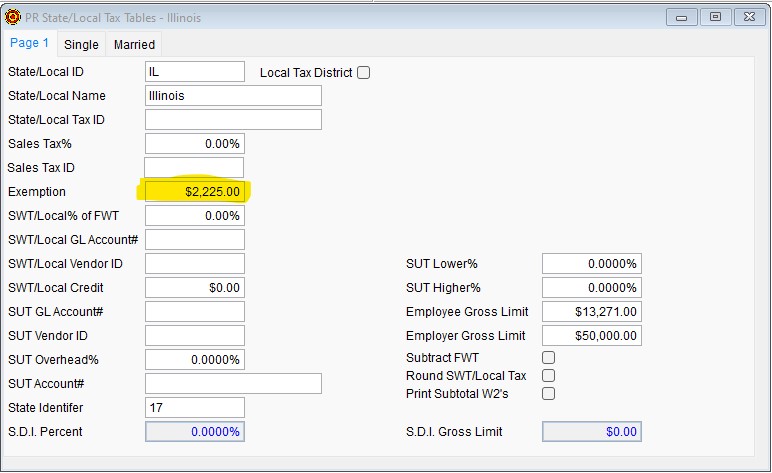

According to Booklet IL-700-T, Employers should use the personal exemption allowance amount of $2,225 to Catch-Up Withholding for their existing employees, for the remainder of 2023.

Since Visual ContrAcct does not allow for 2 different exemption amounts, any new hires, for the remainder of 2023, will also use the personal exemption allowance amount of $2,225.

New hires will be over withheld by a small amount for the tax year of 2023, less than 10 dollars in most cases.

Admin > Payroll > Tax Tables > State/Local > Illinois

Customers with a support contract may email [email protected] or call (630)355-8188 for assistance.