The update includes 2017 IRS 1094/1095C Electronic XML File Feature.

It is your responsibility to determine if you must file form 1095C/1094C to your employees and the IRS and HOW you are to complete and file the forms (paper or electronic). Visual ContrAcct does NOT handle Employers that offer employer-sponsored self-insured coverage. We recommend you contact your accountant, as filing requirements are complex and customer support can NOT advise on filing requirements.

If planning to proceed with IRS 1094/1095C ELECTRONIC filing, begin the process NOW with a review of IRS procedures.

Applicable Large Employers (ALE) who issue 250 or more Form 1095-C to employees for tax year 2017 are required to file electronically on the Internal Revenue Service ACA Information Returns (AIR) system. Here’s what you need to know to get started with AIR:

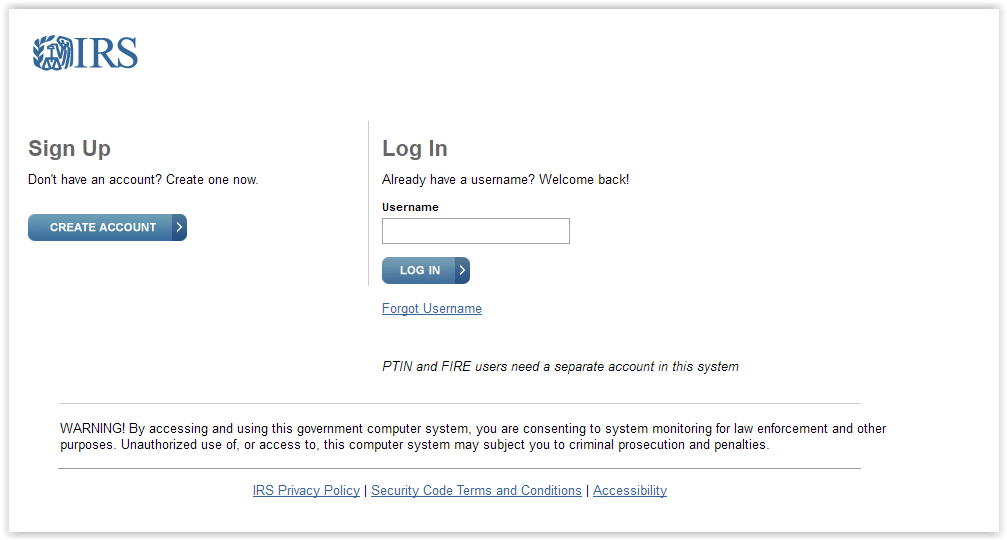

Step 1: Register to use IRS e-Services Tools

Step 2: Apply for your Information Return Transmitter Control Code – TCC

Select Role: ISSUER

Select Form: 1094/1095C

Select Transmission Method: AFA for ACA Internet Transmitter

Step 3: Test Communication with AIR System

The link for uploading test file to the UI channel:

AIR UI Channel Login - AATS (Testing)

Step 4: Electronically Filing through AIR

The link for uploading production file to the UI channel:

AIR UI Channel Login - Production

Filing Due Dates:

https://www.irs.gov/affordable-care-act/individuals-and-families/the-affordable-care-act-whats-trending

IRS Extends Due Date for Employers and Providers to Issue Health Coverage Forms to Individuals…now have until March 2, 2018, to provide Form 1095-C to individuals, which is a 30-day extension from the original due date of January 31. This 30-day extension is automatic. The due dates for filing 2017 information returns with the IRS are not extended. For 2018, the due dates to file information returns with the IRS are:

February 28 for paper filers

April 2 for electronic filers